The Worldwide Developers Conference (WWDC) is when Apple reveals all of the new features coming to its various software platforms. It’s also when developers find out what new technology will be available to incorporate into their apps, at least in theory.

However, one of the most significant updates this year isn’t just for app developers. It is aimed for small enterprises. In a way, yes. It’s really for users, but small enterprises will be the biggest winners.

This is why:

Apple Pay, which Apple created seven years ago as a mechanism for consumers to make purchases when they buy anything by merely tapping their iPhone, is presumably already familiar to you. Later on, Apple offered the ability for companies to accept Apple Pay transactions on their websites.

Apple released its own credit card three years ago, which was largely designed to be used with Apple Pay. There is a beautiful titanium physical card, but Apple will only send it to you if you specifically request it. It’s only designed to be used with Apple Pay.

Apple introduced a service earlier this year that allows customers to collect payments directly on their iPhone without needing to utilise a third-party credit card terminal. Apple has made a concerted effort to become the major means of payment processing.

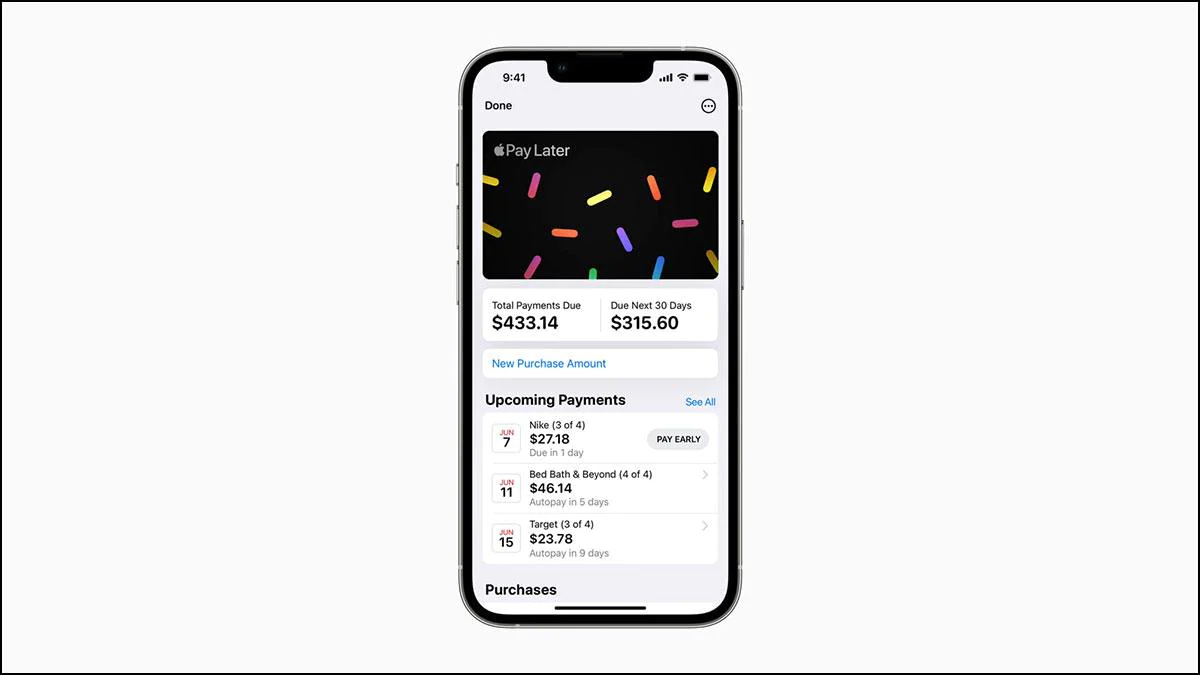

Customers will be able to take out a very short-term interest-free loan from Apple, probably through Goldman Sachs, the bank that backs the Apple Card. Businesses appear to be getting paid the entire amount, as if the consumer had used a Mastercard. It’s unclear whether they’ll notice you didn’t pay the full amount up front.

Apple Pay Later Explained:

Apple Pay Later will allow consumers to pay in six payments over the course of six weeks, beginning with the initial payment. The next three instalments will be spread out over the next six weeks, with one payment every two weeks. All payments will be managed through the Wallet app, and users will be able to make payments in advance if it is more convenient for them.