“Sorry, I cannot help you. We have got the approval as per the rates fixed by the municipal corporation. I can not change the room charges as requested,” a hospital staff member tells a lady who is being discharged after 14 days of Covid-19 treatment.

“But, my problem is I am allowed room charges only up to Rs 6,000 per day. Your charges are higher. Despite having a group insurance scheme and full eligibility, I will not get the claim,” she continues to argue.

“I understand your problem, but I will not be able to change it,” the staffer maintains.

“But I am not asking for any discount. All I want is a change in the room charges,” the lady pleads.

“I am sorry. I can’t help you,” the staffer says politely but firmly.

This incident played out at the billing counter of a Rajkot hospital, but it’s not an isolated one.

With the Covid-19 pandemic raging across the globe since last year, conversations like these have become a common sight across the board as hapless consumers burdened with catapulting medical costs that come with treatment desperately haggle with medical practitioners in a last-ditch attempt to get the most out of their insurance schemes.

As expenses mount, so do insurance claims and premiums.

Calculating losses

By March 31, insurers had received 9.8 lakh claims worth Rs 14,560 crore for treatment of the deadly virus across India. However, in the second wave (April 1 to May 14) insurance companies received another 5 lakh claims worth Rs 8,385 crore. In just 44 days, Covid-19 claims increased by 57 per cent.

A similar surge has been registered in Gujarat, the latest data shows.

As per the data compiled by the General Insurance Council (GIC), the insurance industry has registered 10.07 lakh coronavirus claims worth Rs 14,738 crore until April 7. Of these, insurers have settled 8.6 lakh claims worth Rs 7,907 crore.

Essentially, 85 per cent of the claims have been settled but the amount is just 53.6 per cent of that claimed. A clear example of how the sector operates and why the female patient at the Rajkot hospital was arguing with the billing staff.

“There are two major reasons for rejections – cases where hospitalisation is not required and the absence of an active line of treatment,” explains Deepak Bhuvneshwari, co-founder and CEO of Insurance Samadhan, a company that offers insurance resolution solutions to clients.

“We have handled over 90 cases with a 50 per cent success ratio. Several cases are still pending for resolution,” he adds.

Demand fuels premiums

Before the Covid-19 pandemic hit, the motor insurance segment had the largest share of non-life insurance premiums, a significant section of which has now been ceded to the health segment. Standalone health issuers have reported sustained premium growth of Rs 1,556.9 crore in June, demonstrating a hike of 46.6 per cent. A similar spike has been observed in the quarterly numbers, which grew to Rs 4,222.8 crore from Rs 2,715 crore in June 2020 – a jump of 55.5 per cent.

The rise in demand for health insurance has pushed up premiums. After remaining constant for about six months, the amount is registering a significant increase.

As per PolicyX.com, the health insurance price index witnessed a 4.87 per cent increase in the last quarter. Now, the average insurance premium stands at Rs 25,197, it said in a release. PolicyX.com is a leading insurance aggregator.

“Radical increase in the number of claims due to Covid-19 has led to this stir. Moreover, the additional coverage of several diseases such as mental disorders, genetic diseases, neuro-related disorders, psychiatric disorders etc is responsible for the sharp increase in health premiums,” Naval Goel, Founder and CEO of PolicyX.com said.

“The overall insurance sector is experiencing an escalation. The unprecedented scenario has laid double pressure on the insurance sector and the industry tried hard to manage in the last few months. However, some pressure has to be borne by the customers as well,” Goel adds.

Where does Gujarat stand?

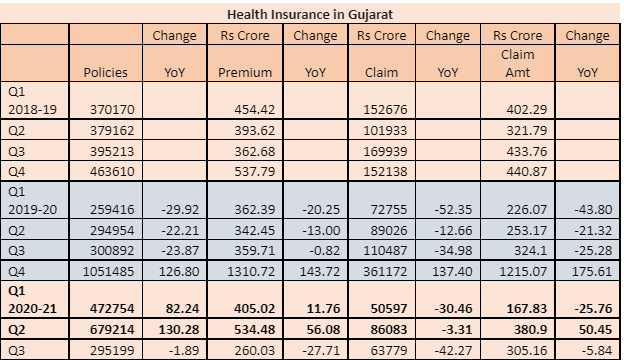

Gujarat also witnessed a major increase in health insurance during the pandemic. As the state-level data is available only till the end of December 2020, the impact of the second wave is not measurable yet.

In the June quarter of 2019-20, 2,95,416 health insurance policies with a premium of Rs 362.39 crore were registered in Gujarat. The number of new policies in last year’s June quarter (the first wave of the pandemic), increased by 82 per cent to 4,72,754 with a premium of Rs 405.02 crore, data from GIC reveals.

However, the biggest jump was witnessed in the September quarter. The total number of policies in September 2020 went up by 130 per cent to 6,79,214 crore while premiums paid rose by 56 per cent to Rs 534.48 crore as compared to the previous year.

The biggest jump in claims was again reported in September 2020. Claims worth Rs 253.17 crore were raised in 2019 that increased by 50 per cent to Rs 380.9 crore in 2020.