Reliance Industries reportedly went out shopping for local five year bonds ahead of an important central bank policy meeting.

The sources informed that the company has bought about $270 million worth of state bonds from a single state-run bank. Some even suggest that the purchases may have been more than $1 billion in the past couple of days based on brokerage orders and trade deals. The details of the deals have been kept private.

The purchases spread through the trading rooms in Mumbai and helped many of the five year sovereign outperform as banks and brokerages as they all seek to fulfil the orders. This comes amidst the expectations that the Reserve Bank of India might tighten the monetary policy soon.

Sources further informed that the company was planning to buy a mix of sovereign and local government debt on the central bank’s dealing platform as well as through direct deals with holders, which would mature in 2026.

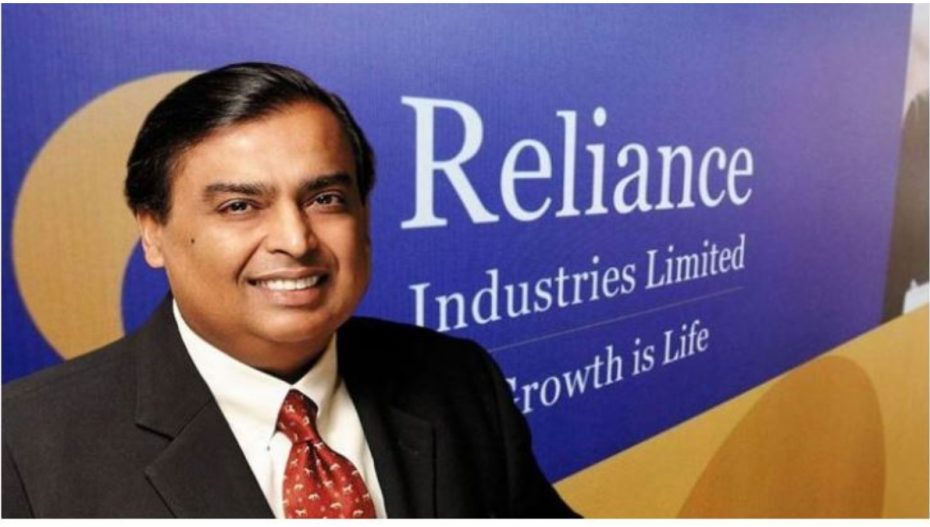

As of September 2021, Reliance by Mukesh Ambani had cash and equivalent assets worth 2.6 trillion rupees.

The purchase comes ahead of an RBI meeting on December 8 that the investors will keep a close check on. The central banks are reportedly planning to normalize the pandemic-era policy settings after they suspended the bond purchases last month.