In order to review the progress in the issuance of KCC to underprivileged farmers from the animal husbandry, dairying, and fishing sectors with Banks & RRBs, Union Minister of Fisheries, Animal Husbandry, and Dairy, Parshottam Rupala, attended a meeting presided over by Union Minister of Finance, Nirmala Sitharaman on Thursday July 07,2022.

In the meeting yesterday, Parshottam Rupala proposed a few steps for banks to follow in order to comply with the KCC Guidelines, including giving applicants the correct receipt for their KCC applications and setting a deadline for a decision. In order for field officers to correct the forms and submit them again, he emphasised that the grounds for rejection should be stated.

People from the Maldhari (Ghumantu) Community, who don’t dwell in one place and have no collateral security to offer, should be given KCC, the minister suggested. Additionally, he suggested those fisherman in need who lack collateral should be granted KCC. According to the minister, these initiatives should focus on stepping up the Ministry of Fisheries, Animal Husbandry, and Dairy’s efforts to fully saturate KCC throughout the nation.

Pankaj Choudhary, Union Minister of State for Finance, Atul Chaturvedi, Jatindra Nath Swain, Sanjay Malhotra, and Jatindra Nath Swain, Secretary, Department of Fisheries, were also present.

The extension of the Kisan Credit Card (KCC) programme to fisheries and animal husbandry farmers was announced by the Indian government in the Budget 2018–19 in order to assist them in meeting their working capital needs. The KCC facility will assist farmers engaged in fisheries and animal husbandry in obtaining the short-term credit they need to raise livestock, poultry, fish, shrimp, and other aquatic species, as well as to catch fish.

The Department of Fisheries is attempting to determine whether it is possible to expand KCC to include fishermen who are not currently covered, such as those who do not own/lease boats or other assets. The DoF advises States/UTs to frequently check the status of the KCC’s saturation of eligible fishermen and fish growers and appropriate follow-up action must be taken with the concerned banks for removing shortcomings and ensuring early sanction of KCC.

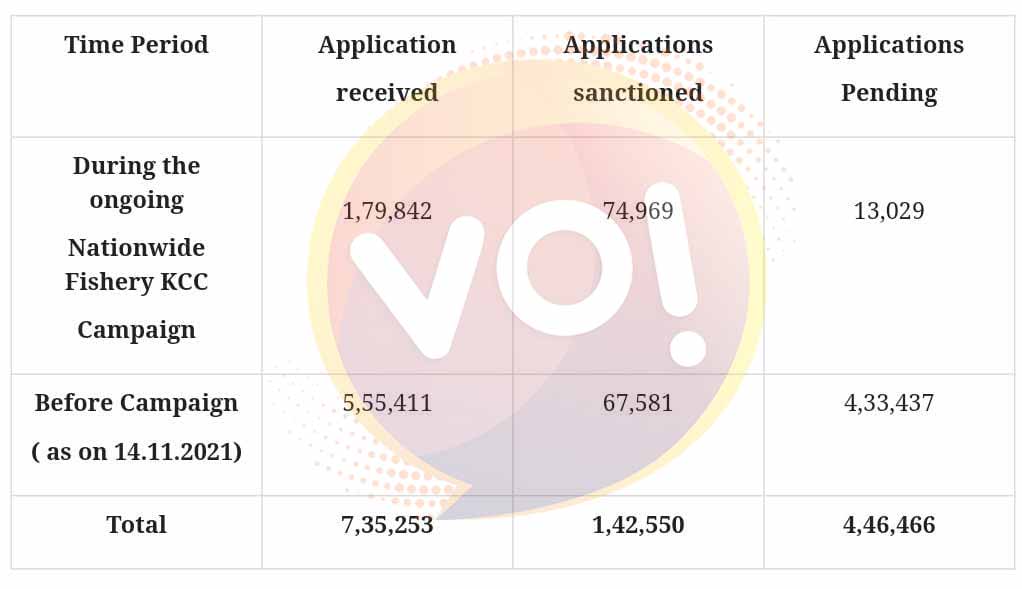

Progress of ongoing Nationwide Fishery KCC Campaign, as reported by DFS on 24.06.2022 as well as the applications received before the said Campaign:

Animal Husbandry Farmers now have access to Kisan Credit Card (KCC) services in 2018–19. As a result, they are guaranteed short-term finance to cover their needs for operating capital, such as feeding, veterinary care, labour, water, and energy. This Department established a Special Drive from 1 June to 31 December 2020 to provide KCC to qualified dairy farmers of Milk Cooperatives & Milk Producer Companies. Only about 30,000 KCCs had been approved for animal husbandry and dairying prior to this initiative.

Over 50 lakh applications were sourced during this time, of which 18.81 lakh fresh KCC were approved. The campaign’s overall progress is provided as follows;

An online portal for the AHDF was created by the department of AHD in collaboration with SIDBI.

KCC. The portal is about to go live. This gateway will make it easier to submit, handle, and monitor information online. Banks are asked to make it easier for this portal’s API connectivity with their banking system so that real-time monitoring is possible.

Also read: Nirmala Sitharaman Might Just Have Put Her Foot In The Mouth