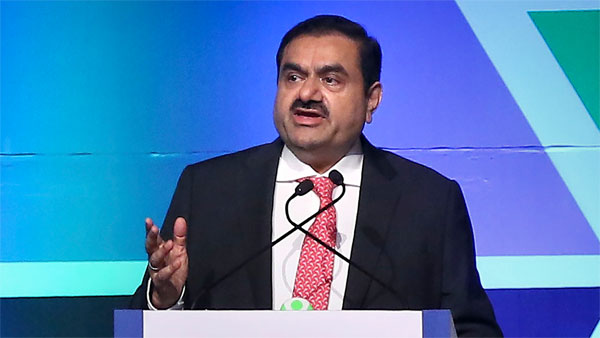

The US government has emphasised while concluding that short-seller Hindenburg Research’s allegations of corporate fraud against Adani Group were not relevant before extending self-made billionaire Gautam Adani’s conglomerate as much as $553 million for a container terminal in Sri Lanka, a senior US official said.

The Sri Lankan port deal involving Adani is one of the biggest and most prominent US government-backed infrastructure projects in Asia. US supporting projects in Asia leaving out China is a good sign for India, policy experts told Vibes of India.

According to reports, the US agency came to this conclusion after in-depth due diligence. Allegations in a bitterly severe and scathing report by US-based Hindenburg Research, which erased around $100 billion from the Adani Group’s market value earlier this year, were front and centre as the International Development Finance Corp. or DFC, conducted a due diligence investigation of the conglomerate, America has officially said.

The Development Finance Corporation was satisfied that the accusations in the short seller’s report, which said Adani was pulling off “the largest con in corporate history,” weren’t applicable to Adani Ports & Special Economic Zone Ltd., the subsidiary spearheading the Sri Lankan project, according to a DFC official who sought anonymity.

The Adani Group has denied the allegations featured in the Hindenburg report, including stock-price manipulation. Formal regulatory inquiries and court hearings into the issue in India haven’t uncovered any wrongdoing. Adani stocks have rallied of late, and Adani Ports and Special Economic Zone Ltd. has gained 7.4% so far this year.

The Adani Group has touted the DFC’s investment as a vote of confidence following the Hindenburg allegations.

“We see this as a reaffirmation by the international community of our vision, our capabilities and our governance,” Karan Adani, Gautam Adani’s son and chief executive officer at Adani Ports, told reporters in Colombo when the deal was announced.

Only earlier this year, Gautam Adani, the fourth-richest person in the world, lost half his wealth in a flash. The phrase that his group had pulled off, “the largest con in corporate history,” seemed tattooed on his chest, with him even facing politically motivated attacks in India.

Slowly and indeed, the tide has been turning. The group has been winning investors’ faith and, what’s more, regaining lost ground and reputation.

Today’s decision by America comes at the right time to restore the image and credibility of Gautam Adani and his group.

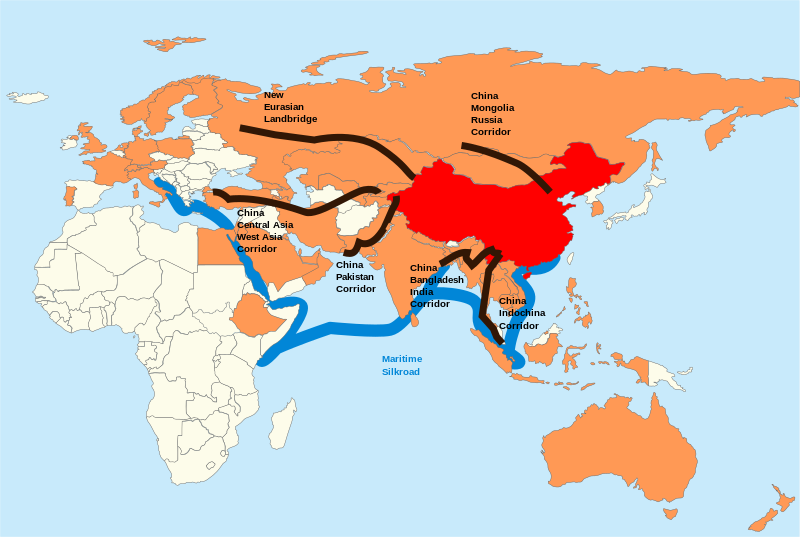

The Adani-backed port deal in Sri Lanka is one of Asia’s most significant infrastructure projects, supported by the US government. It follows years of the US’s efforts to resist China’s expanding influence in the area due to President Xi Jinping’s global infrastructure-building initiative, the Belt and Road Initiative.

The Adani Group had refuted all of the accusations, including manipulating stock prices, that were included in the Hindenburg report. In India, official regulatory investigations and legal proceedings regarding the matter have not revealed any misconduct on the group’s part.

Meanwhile, Adani’s stocks have surged, with Adani Ports and Special Economic Zone Ltd. gaining 7.4% so far this year.

The Business Today reported, “Adani Energy Solutions Ltd and Adani Power Ltd gained four per cent each to Rs 938.10 and Rs 484.05 with a total market valuation close to Rs 1.05 lakh crore and Rs 1.85 lakh crore, respectively. Adani Wilmar rose more than three per cent to Rs 357, with a total market cap of Rs 47,500 crore.”

It must be recalled that, besides Congress, Mahua Moitra, an MP from TMC, has been consistently raising the Adani issue. Today’s development should mellow Adani critics, a senior Congressman said, adding that it was wrong to criticise and malign Adani without any concrete evidence.

The Adani story seemed almost over. Now, it’s being rewritten all over again.

Also Read: Crimes Against Women and Children, Suicides, Sudden Deaths Increased in 2022: NCRB Report