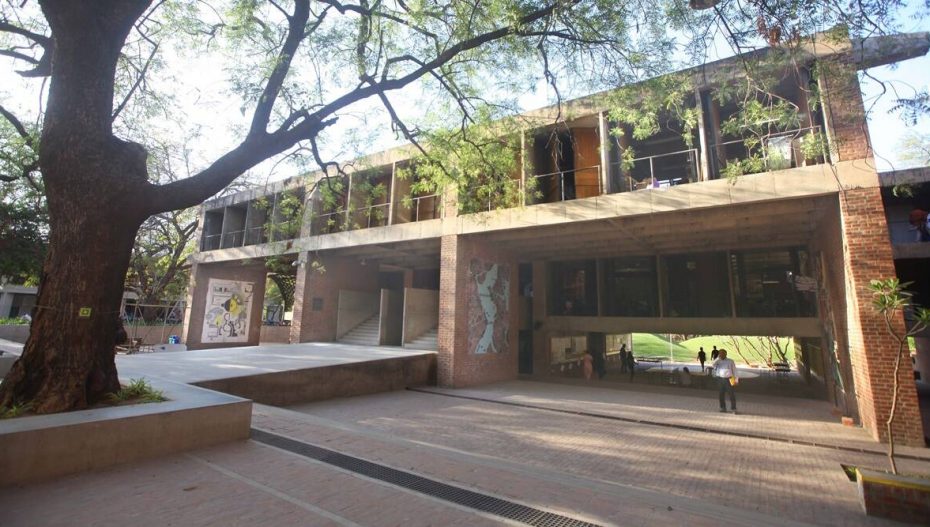

Even as new townships come up on the outskirts of the city, there are large areas within Ahmedabad that are ripe for redevelopment. What is stopping them? The workings of the real estate market are complicated and often opaque, but a glimpse is provided by an academic project at CEPT University, the findings of which are currently on display at the CEPT Winter Exhibition.

Nineteen students of CEPT’s School of Planning were called upon to study ten large sites in the city to figure out whether it was feasible to redevelop them. “These are real sites and the feasibility studies our students have produced can help builders take a decision on whether to redevelop them or not,” says Madhu Bharti, the faculty guide for the project.

One of the sites is a set of four adjacent Gujarat Housing Board (GHB) colonies (Paras Nagar, Surya, Karnavati Laxmi Krupa and Chandra Societies) in Naranpura, which presently has 1760 dwellings spread over 8.6 hectares. Since it is a fairly upmarket area, with great connectivity, CEPT post-graduate student Kritee Mondal has created a redevelopment plan with 13 towers of 15 stories. After providing for new flats for the present occupants, the builder can use the free sale component to build 2BHK, 3 BHK and 4BHK luxury homes for sale in the open market. In the best-case scenario, the builder could make a profit of Rs 300 crore in the 12 years it would take to complete the project.

Two factors, however, get in the way of redeveloping a GHB colony. Firstly, the occupants have built extensions to their homes over the years, sometimes doubling the original floor space. In negotiating with the builder, they would expect a 140% increase in floor space for new flats. Secondly, the GHB bidding process requires the builder to not only share profits, but also pay a premium for the land which is owned by GHB. It is this premium which determines who wins the bid.

“The project is viable on paper, but there are risks such as delays due to obtaining consent from the present owners and uncertainties in the tendering process. Builders will not go for redevelopment of such old colonies unless GHB addresses these issues,” says Kritee.

Indeed, most of these sites have to compete with greenfield sites and builders tend to prefer the later because they come with less uncertainty. Another potential site studied by the CEPT students is a slum colony in Nikol. Spread over 7.2 hectares, Indiranagar no Tekro has 1200 dwellings. A builder redeveloping the site would have the option of creating an additional 1300 units for free sale, but given the area, these units would have to be for the low-income category. The builder would get Transfer Development Rights (TDR) that come with slum redevelopment, but this would only come after the completion of the project, which would take at least 10 years, according to CEPT student Hasti Bhatt. “Our conclusion is that the project is not feasible in present circumstances. There are vacant sites nearby which any builder would prefer over this one,” she says.

In the absence of feasible alternatives, it seems slums are here to stay in Ahmedabad. However, the scenario becomes more optimistic when it comes to redeveloping Cooperative Housing Societies (CHS). CEPT student Udisha Bhattacharya looked at a cluster of seven CHS in Nirnay Nagar, with 887 dwellings spread over 9.2 hectares. Out of these, 70 home owners want to opt out of the redevelopment scheme and receive cash compensation instead.

Udisha’s plan is for the construction of 2200 units on the site, of 1BHK, 2BHK and 3BHK along with underground parking, landscaped gardens and clubhouse. The buildings would be 14-storied and the 2 BHK and 3BHK units would be of two types: basic and luxury. “The project would be feasible if the builder sells 80% of the flats and completes the project within 9 years. Beyond that period, costs of raw materials like steel and cement would increase and put pressure on the margins,” she says.

The Nirnay Nagar neighborhood currently has newly constructed buildings with more than 20% unsold housing stock, but this is largely due to the slowdown brought on by the Covid pandemic, the feasibility report says. The situation is expected to ease in nine years, by the time the project is completed.

The most optimistic feasibility report comes from CEPT student Akshay Ravindran, who has looked at a cluster of five CHS, with 724 dwellings and 38 shops spread over a nine-hectare area in Khokhra. “The houses here are quite dilapidated and the residents are waiting for an opportunity to upgrade their lifestyles. More than 80% of them have said ‘yes’ to redevelopment,” he says.

These real-life projects give the CEPT students a chance to get acquainted with the hundreds of laws pertaining to construction in the city. For example, the Khokhra site is on a narrow road off the main street, so the height of any building here is restricted to seven floors, which translates into a Floor Space Index (FSI) of 2.7. The plan is to construct a township of 32 towers, with 2100 flats and 120 shops, of which 40% will be 3BHK, 40% 2BHK and the rest 1BHK.

Talking into account a 7% annual cost escalation, Akhshay estimates the project had the potential to breakeven in five years, with 45% of the units sold. Upon completion in eight years, the builder will make a profit of around Rs 325 crore.