Although most private sector banks withhold the remuneration details of senior executives in the annual reports, the shareholders can specifically request the disclosure from companies. The remuneration disclosure provides valuable information on the quantum of monetary compensation that reveals how senior managers have been appraised and compensated.

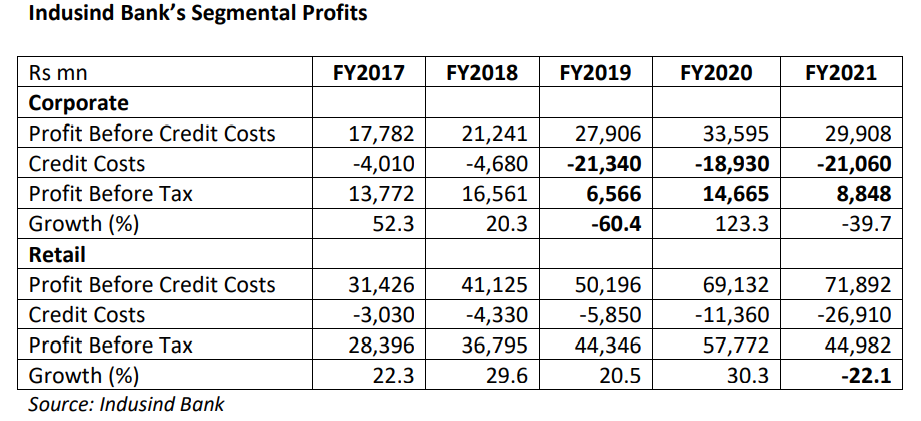

As per Hemindra Hazari, the scale of remuneration in the Indusind Bank reveals how Ramaswamy Meyyappan and the corporate credit team were handsomely rewarded for doing high-risk, poor-quality loans to companies like CG Middle East, Sprit Infrapower. Thereafter their remuneration declined in FY2020 and for some, it recovered in FY2021.

Indusind Bank has declined to provide any clarity on the reasons for the increase and decrease in individual remuneration.

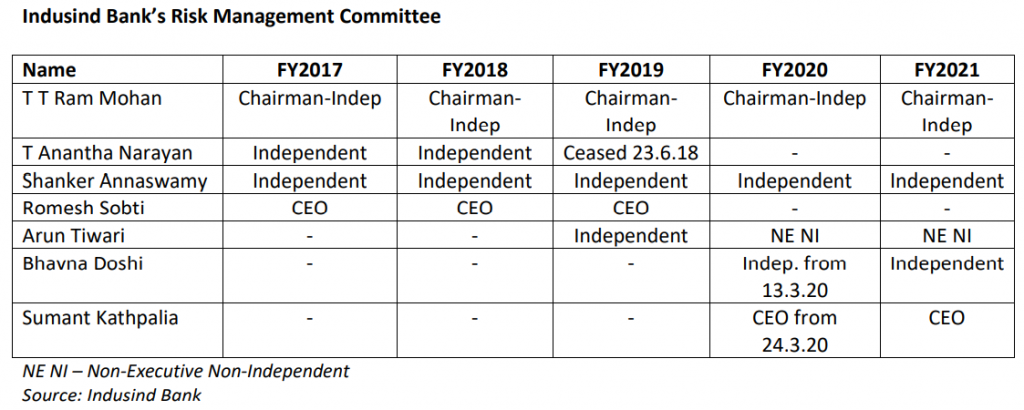

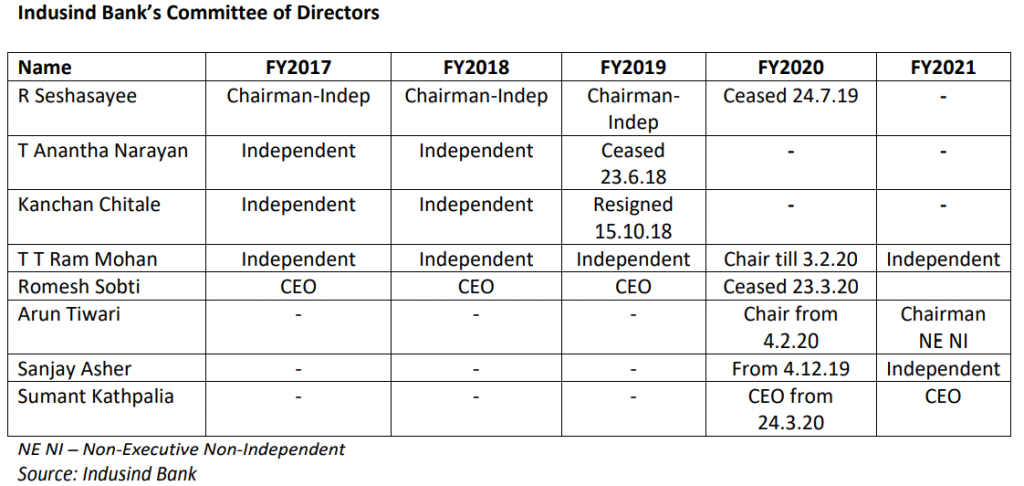

The lesson to stakeholders is that, when times are good, senior executives will be richly rewarded, and when times turn sour on account of their incompetence and/or complicity, they will still retain their jobs. The only punishment will be a reduction in their remuneration. As long as such individuals are blessed by the CEO, their jobs are secure, and there is negligible accountability for their disastrous acts which result in losses to the bank and to shareholders