In the current scenario, Indian equity markets are giving equal opportunity to risk-takers and risk-averse. On one hand, when new investors are queuing up for new account openings for stock trading, some of the investors are liquidating their holdings.

Experts believe investors liquidated their portfolio as fear gripped the market when Covid-19 cases started rising. During the lockdown when most economic activities were not allowed job losses, pay cuts also prompted profit booking. However, as things settled sentiments changed and investor participation has undergone a major shift.

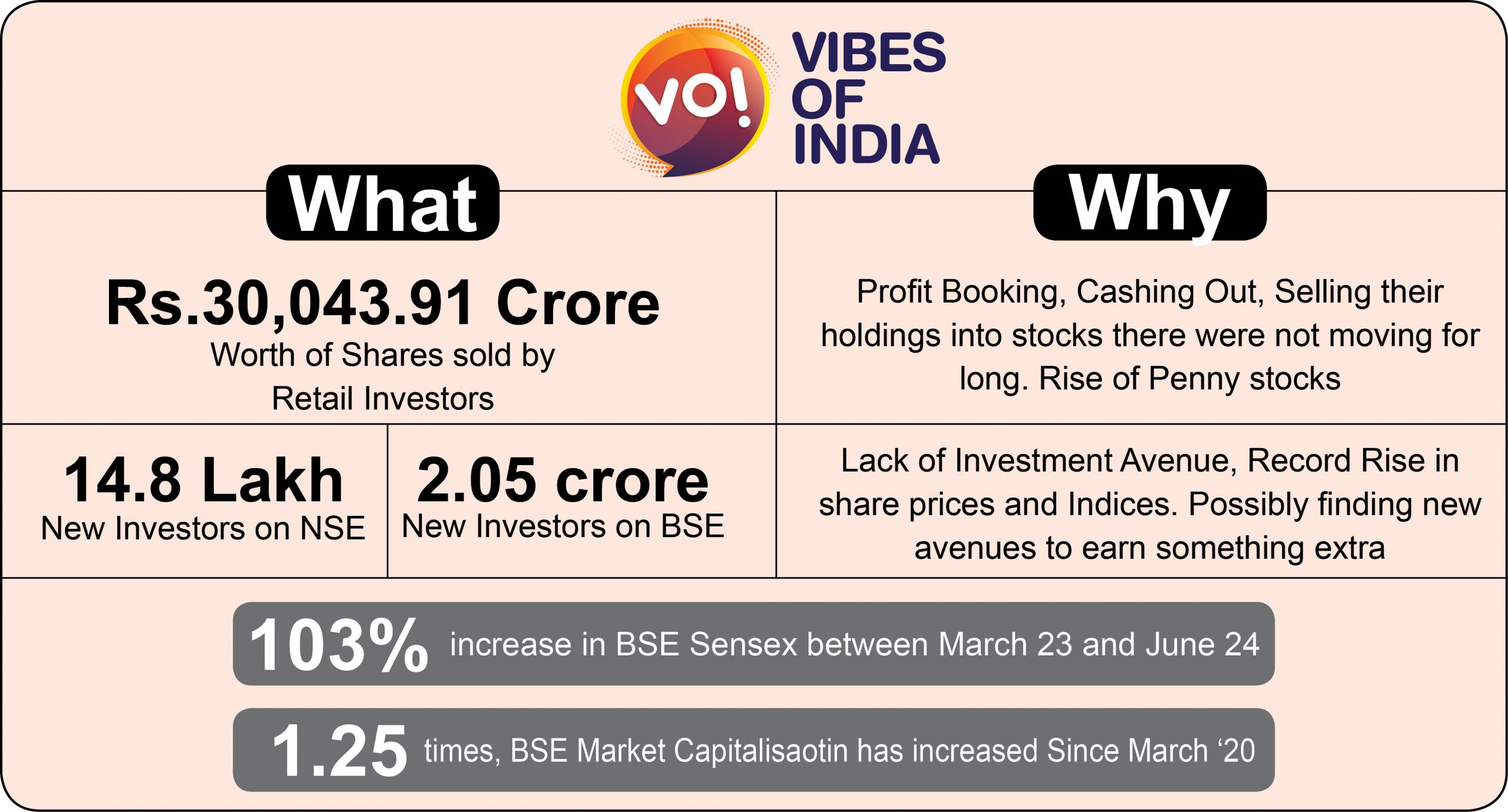

Retail investors have sold shares worth Rs 30,043.91 crore during the ongoing pandemic (April 2020 to May 2021), daily data collected from the exchanges show.

Contrary to this, the number of registered investors on the Bombay Stock Exchange (BSE), has increased by 40.5 percent i.e. 2.05 crore in June from a year-ago period. Similarly, the pace of new registered clients on the National Stock Exchange (NSE) has more than doubled. In June 2020, new client registration with NSE was 5.64 lakh, it increased to 14.84 lakh in May this year.

From the lows of 25,981 Sensex – the benchmark index of Indian stocks – has gained 103 percent to 52,699 on June 24. With the rise in index level, investors’ wealth as measured in terms of market capitalization has also gained by 1.25 times Rs229.38 lakh crore in the same period.

Retail Investors on Selling Spree

“Initially, people would have liquidated portfolios fearing of risk and sudden crash in the stock market. However, retail investors are coming back. Their new investment is higher compared to their sale or profit booking,” Amit Shah, city-based investment advisor says.

Zerodha, the country’s largest retail brokerage house by active client base believes that investors who have had emergencies would have drawn on their investors. But it adds that lucky investors are continuing their regular investment.

The other explanation for retail investors booking profits could be a surge in broader markets. Essentially those shares that were not moving for a long time.

After hitting highs in January 2018, the Nifty Midcap index remained under pressure until December 2019. Similarly, Small cap Index was not moving much. On the contrary, benchmark, Sensex and Nifty or a few large stocks were driving the rally. The situation has changed now.

“There could be multiple reasons for the retail investors booking profits. First, since the markets are at record high and valuations seem expensive, they choose to book some profit off the table. Besides, we have seen a tremendous surge in the broader markets also in the recent past so those who were stuck with the positions in the past might be liquidating,” explains, Ajit Misha, VP- Research, Religare Broking Ltd.

The retail segment, buying and selling of shares further reveal diverging trends on both the exchanges. For, Bombay Stock Exchange (BSE), the retail category has been net sellers (selling amount is more than buying amount), for 12 of the 14 months. Against, this net selling activity was witnesses only for five months on the National Stock Exchange (NSE).

One of the reasons for divergence could be there more companies listed on BSE compared to NSE. Another argument is penny stocks. Penny stocks are those stocks that attract low investors’ attention, trade at a lower price and mostly illiquid.

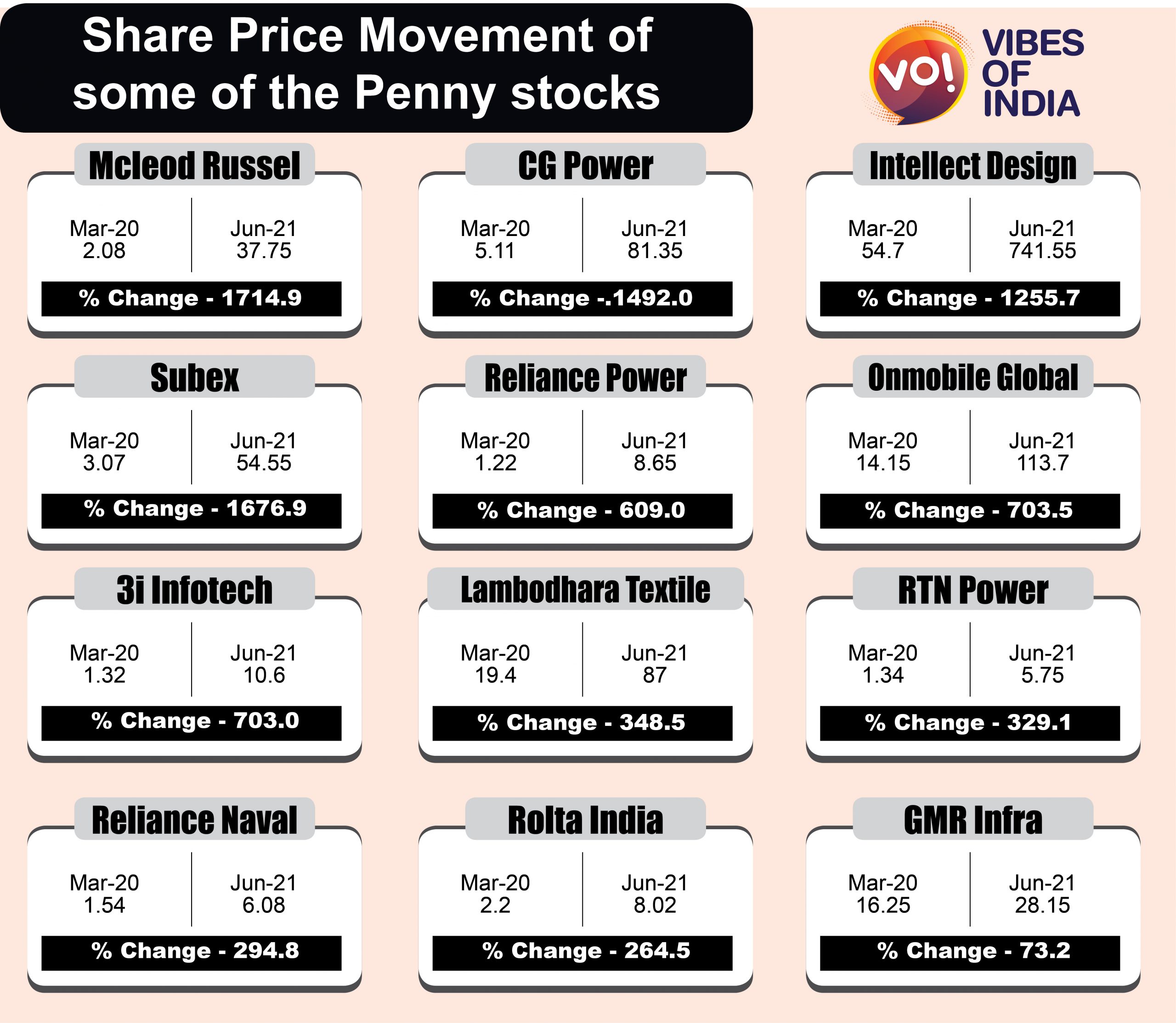

Share price data fetched from BSE shows, share prices of these penny stocks increased between 73 and 1700 percent.

“There are several shares, which are trading at a much higher level compared to December 2019. It is providing an opportunity for investors to book profits or exit their holdings. Some of these stocks are penny stocks. They have waited for years to get out them,” Yashwant Rajput, a sub-broker based in North Share Price Movement of some of the Penny stocks.

New Investors Queuing

The new data registration indicates a euphoric tilt towards equity markets. Though, selling has been intense on the bourses, the share of retail investors has remained stable.

“The share of retail investment as percentage holding of total shares in all listed NSE companies was declining steadily between 2001 and 2012. However, since then it has remained stable between 8.5 and 9.5 percent to March 2021,” India ownership tracker from the NSE reveals.

Financial Year 2020-21 has been probably the best in terms of increased retail participation. For NSE, total new registration has jumped six times in the last two years. Total new registered users addition in May 2021 was 14.8 lakh.

“We are seeing a lot of first-time investors. With most people now working from home, they have time on their hands. So, people are spending, evaluating their personal finances and have started investing directly. Mutual Fund SIPs (Systematic Investment Plans) have the go-to choose for most people to start investing. Of course, the market sentiment helps too,” information shared by Zerodha reveals. Meanwhile, some individual investors are also looking at supplementing their income, hit by salary cuts or benign bank rates. “We are witnessing increased participation. Many are considering this as a supplement to their earnings. Besides, the phenomenal performance of the newly listed IPOs attracted their attention.,” Ajit Misha, VP- Research, Religare Broking Ltd.