One year after it was opened, the country’s first international bullion exchange, the India International Bullion Exchange (IIBX) at GIFT-IFSC in Gandhinagar clocked its highest single-month turnover of gold in September, trading 1,230.2 kg of the yellow metal, with a total transaction value of $76.01 million.

Since the exchange became operational on July 30 last year, 2.2 metric tonnes (MT) of gold has been traded on it.

Experts at the exchange attribute the growth to increasing demand and the seamless procurement process through the exchange.

The highest weight of gold traded in a single day was 216kg on September 26, sources said.

Experts said, the demand for gold has been good. With the greater ease of trading and efficiency compared to physical gold that the Icegate process allows, IIBX is slowly becoming the preferred mode of importing gold.

Ever since the exchange began offering settlements within 30 minutes of bullion depository receipts (BDRs), several qualified jewellers have begun trading.

Recently, the Indian customs and central excise electronic commerce/electronic data interchange (EC/EDI) gateway, Icegate, was integrated with IIBX to facilitate customs clearance.

As a result, gold procured from the exchange is available at a 1% duty discount under the Comprehensive Economic Partnership Agreement (CEPA) between India and the UAE.

The tariff rate quota (TRQ) for importing gold under this agreement is 140 metric tonnes for 2023-24, according to the directorate general of foreign trade (DGFT).

“IIBX has been raising awareness levels about the benefits of trading on this platform, which has led to more qualified jewellers coming aboard. Over 100 qualified jewellers are currently on board for trading both TRQ and non-TRQ gold,” Gautam added.

IIBX is the first global bullion exchange to offer bullion depository receipt (BDR) settlements every 30 minutes.

The exchange operates from 9am to 5.30pm, with 17 slots for BDR settlements, every half hour. This means that every 30 minutes, BDR receipts are transferred to the demat accounts of qualified jewellers.

The exchange also has 20 registered suppliers of gold. To further improve trading volumes, discussions are underway about bringing banks on board as qualified trading partners.

Also Read:

- The Rs 60,000 Crore Question the BJP Needs to Answer About its Financials

- Islamabad Want Rahul Gandhi To Be India’s PM

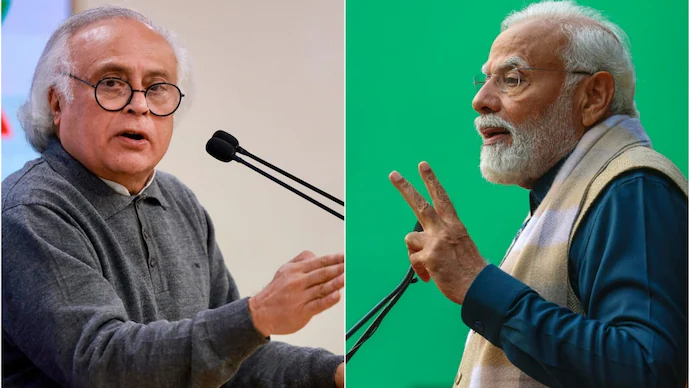

- Congress Questions PM Modi’s Silence on Gujarat’s Paper Leak Epidemic

- Alleged Mastermind in Sidhu Moosewala Murder Case, Goldy Brar, Reportedly Shot Dead in California

- Salman Khan’s House Firing Case: Arms Supplier Dies By Suicide

- Rupali Ganguly Joins BJP Ahead of Lok Sabha Elections