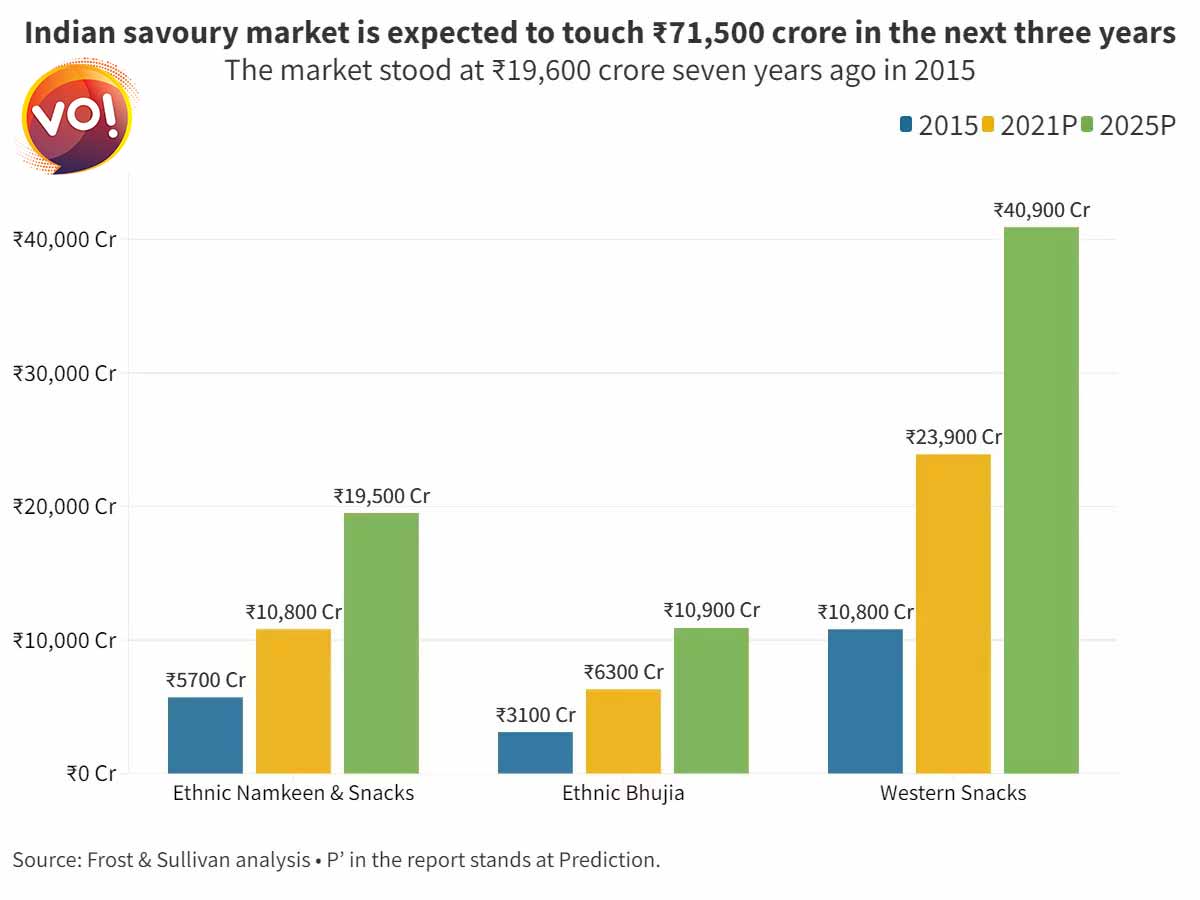

Three in five snacks sold in India are Western. Overall, the organized Indian snacks market stands at ₹41,000 crore. But the desi namkeen segment has been losing out on their market too due to four factors: flavours, pricing, consistent availability and convenience of buying of Western brands.

India’s traditional snacks have lost their market share to the Western-influenced preparations. Three in five snacks sold in India are a blend of western flavours with Indian grains. “With increased penetration and movement from Indian ethnic to Western snacks, regional players are now competing with established Indian and international players,” a recent report by ICICI Securities read.

Overall, the organized Indian snacks market stands at ₹41,000 crore with PepsiCo, ITC, DFM Foods, Prataap Snacks and a few others dominating the sector. However, in recent times, mid-size players like DFM Foods, Balaji Wafers, Pratap Snacks, Maiyas and Laxmi Snacks, stand faced with the “popular preference” denting their prospects too.

The Indian savoury market is driven by Western snacks with a market share of roughly 58.3%. The ethnic namkeen and snacks’ market share is at 26.3%; and ethnic bhujia has a 15.4% market share. In other words, if 10 snacks are sold in India, six would be Western, three would be ethnic and one would be bhujia.

The Indian ethnic snack market is led by Haldiram, with IPO-bound Bikaji one of the top contenders in the north and eastern Indian markets.

The data shared above does not include the unbranded Indian snacks or the desi namkeens that are usually sold in small kirana stores, chai tapris and other such stores.

Also Read: Drug Major Cadila Pharma Inaugurates New Lab At Dholka