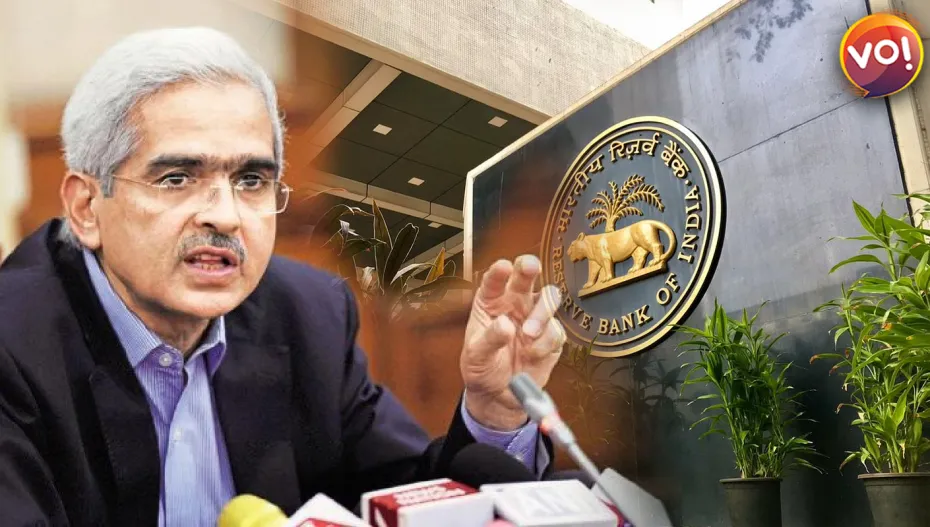

RBI Governor Shaktikanta Das announced on Thursday that the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) has decided to maintain the repo rate at 6.5 per cent. This decision comes after the central bank’s previous meeting in April, where it put halt to its rate hike cycle and kept the repo rate unchanged.

The MPC meeting, which commenced on Tuesday, took place amidst expectations of the RBI keeping benchmark interest rates steady to address retail inflation and stimulate economic growth.

Governor Das revealed that the Standing Deposit Facility (SDF) rate will remain at 6.25 per cent, while the marginal standing facility and bank rates will stand at 6.75 per cent. He emphasized the strength and resilience of the Indian economy and financial sector, particularly in the face of global uncertainties.

The decision to maintain the repo rate follows a decrease in consumer price-based (CPI) inflation, which reached an 18-month low of 4.7 per cent in April. Governor Das indicated that the May figures are expected to be even lower. The government has set a target for the RBI to ensure CPI inflation at 4 per cent with a margin of 2 per cent on either side.

Governor Das also provided insights into India’s projected GDP growth for the respective quarters of the current fiscal year. The growth rates are estimated at 8 per cent for the first quarter, 6.5 per cent for the second quarter, 6 per cent for the third quarter, and 5.7 per cent for the fourth quarter. Additionally, the RBI has pegged India’s GDP growth at 6.5 per cent for the entirety of the fiscal year 2023-24.

The decision to maintain the repo rate and other key rates reflects the RBI’s efforts to balance inflation control and support economic recovery. As the central bank continues to monitor and respond to evolving economic conditions, the focus remains on sustaining stability and fostering growth.

Also Read: BBC Tells Income Tax Dept: May Have Under-Reported India’s Income