The New Year will begin with an increased Goods And Services Tax on textile and footwear. The GST slab is increased to 12% from 5%–on textile. The traders are already up with their grievances; meanwhile the big question is: will Union Budget 2022 bring any major changes for income tax slabs? Considering the new Covid variant Omicron and the uncertainty that looms due to it, it is unlikely that the next budget will adversely impact household income and savings.

Currently, the economy has still not recovered from the Covid slug and household incomes are still stressed. The latest domestic product data show that private final consumption expenditure was still below pre-pandemic levels.

Another reason for the ministry to maintain stability in income tax slabs is the forthcoming elections in states like Uttar Pradesh, Punjab and Gujarat. The political leadership is likely to go with the view of keeping rates unchanged.

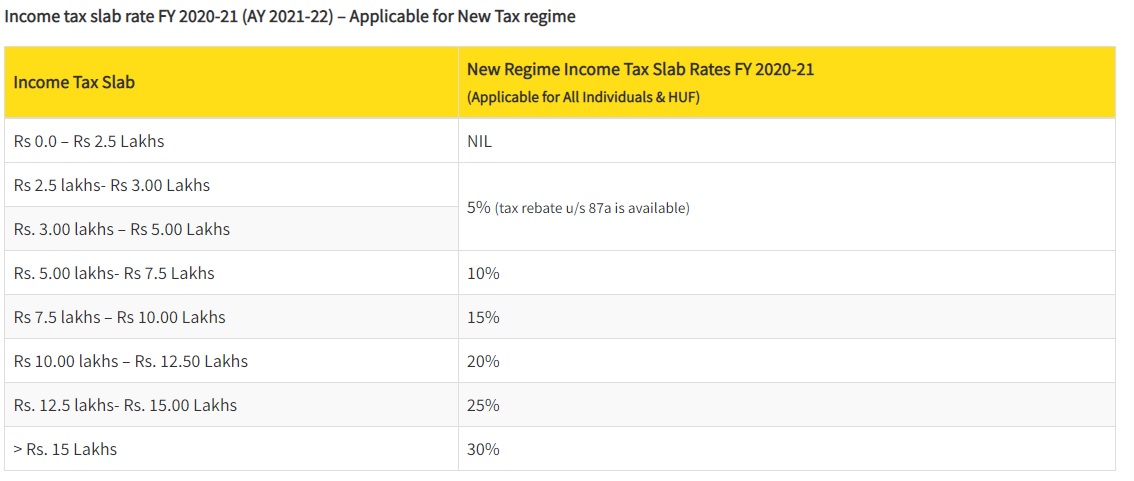

The last amendment in the personal income tax slab was made just before the pandemic. Union Finance Minister Nirmala Sitharaman had lowered tax rates to 15% from 20% for the Rs 7.5-10 lakh slab. The tax slab on 10-12.5 lakh was reduced to 20% from 30%.

If the existing rates are changed, while some sections of taxpayers may benefit, others may see a rise in their income tax liabilities. Any change in tax rates could be counter-productive.

What is included in personal tax slab?

Personal Tax slabs involve a person’s basic salary, perquisites, taxable allowances, and even any profit they have made from their salary. This also means that the pension a person receives on retirement is taxed based on income tax. The income obtained from salary and pension is then added to the computation of taxable income.