Romel Sutariya, a convener of Gujarat-based NGO ‘Ek Awaaz Ek Morcha’ has claimed that a massive chit-fund scam of INR 10,000 crore bigger than the Saradha Group Financial scandal has silently crumbled the state after he mustered all the essential testimonials and documents from the local investors based in different parts of Gujarat.

Saradha Group had allegedly run chit fund operations spread over the states of West Bengal, Assam and Odisha till 2013. The quantum of total money mobilised by the accused company was over INR 2,459 crore out of which INR 1,983 crore remained unpaid to the depositors to date (excluding the interest amount).

The activist Romel Sutariya had extended his support to the victims of the chit-fund scam. In a bid to get them the desired justice, he compiled all the substantial details to strengthen the case against the illegal fund operations that had happened across the state.

While speaking to Vibes of India, Sutariya said- “A relief package must be announced by the Gujarat government for the victims of multi-crore chit fund scam, the way a relief package was offered to the victims of Saradha chit fund scam. Besides, a separate SIT must be constituted and a state-based ‘Grievance Redressal Mechanism’ must be formed. An appropriate compensation must be provided to the family and kin of the deceased, who have committed suicide in the backdrop of the scam.”

Numerous micro-finance companies from different states of India had set up their offices across the tribal belts of Gujarat and had lured them by offering tall promises of providing considerable returns.

The scam has appeared to be even bigger and wider than Kolkata’s Saradha chit-fund scam that had scandalised the whole nation. The micro-finance companies had hired locals as commission agents to make their business flourish across multiple states.

Subsequently, most of the companies turned out to be frauds. They had made towering promises regarding deceptive investment schemes and had lured unemployed youths by offering them higher remunerations and commissions, but ultimately, they all fled away after making huge profits.

Over 5 lakhs of complaints were registered against this scam, but no hearing has been made till date. Most of the investors are less educated and agricultural labourers and could hardly earn for their survival. These forged companies made an easy target to the tribal belts ranging from Ambaji, based-in-Banaskantha district to Umargam, also known as Umbergaon, which is based in the Valsad district of Gujarat.

According to sources, in the year 2017, the Gujarat government had claimed that a big chunk of money worth INR 713 crore was invested from around 4,62,687 lakhs of people hailing from Surat, Ahmedabad, Vadodara, and Rajkot districts of the state.

An investor, Manglaben Gamit, 70, from Tapi’s Champavadi village, who fell for one of such pyramid schemes, narrated her awful story- “Initially, I used to deposit INR 20 in ‘Oscar’ (a chit-fund scheme) to strive for my life, as I don’t have any support to back-up my old-age days. I have lost nearly INR 50,000 that I had earned with my sweat and blood. I need my money back. It would be a great help to this poor.”

Another testimony to display the tragic event of chit-fund scam victims was narrated by the co-villager of Manglaben, Savita Gamit. She said- “Due to lack of support in my old-age days, I had to run a small tea shop. I had deposited nearly INR 40,000 in the Oscar scheme for the whole two years. Whatever, I had earned from the shop, (I had invested in the hope to get back extra in return). I was expecting to use some of its amounts for house maintenance and the rest to cover up my old age. But I have been cheated.”

Sunilbhai Moti Vasava, who was associated with a company called Shagun (a real estate developer), had over 4000 investors in the Rajpipla district. Lured by the tall promises of getting higher interest rates and huge commissions, Sunilbhai made his own investments too that accounted a sum of INR 30 lakhs. He had collected over INR 1 crore from the investors.

Unexpectedly, the news about the company’s collapse broke. The associated officials fled away. Complaints were registered against the fraudsters, but the cases were unheard of for a very long time and no interventions were made by the authorities. Eventually, Sunilbhai Moti Vasava killed himself out of remorse.

Sunil’s better half Shakuntala stated, “The investors continuously made their visits asking to return their money back. Their constant push crafted Sunil under a severe mental breakdown. The chit-fund scam had given a huge setback to my husband.”

She reiterated, “No appropriate actions have been taken by the police authorities against the accused. The investors are struggling to get the desired justice. They want their money back.”

Ambaben Ashwinbhai Patel, a resident of Paldi taluka of Valsad district said, “In 2012, I came in contact with a company named- ‘Jai Vinayak’. In the beginning, I started depositing higher amounts based on the tall promises offered by the company. It became a routine business. Starting with an initial deposit of INR 500 per month, I had invested a total amount of INR 1.3 lakh rupees all these while.”

“The company promised to return the money in a span of five years, but it collapsed before it could complete its fifth year. I had lost a huge amount of INR 1.3 lakh,” Ashwinbhai Patel said.

The dreadful story didn’t conclude here. Swayed by its towering promises, Patel started working as an agent for the company. From a total number of 150 clients, he received an amount of INR 20 lakh, which he had deposited along with his personal investments within the company. With the collapse of the company, all the made investments sank. The investors are struggling now, asking for their money back. How could I return when I have had them deposited in the company?”

Another victim of the chit-fund scam, Meenaben Nattubhai Ahir said, “I had deposited nearly 1 lakh 50 thousand rupees in ‘Jai Vinayak’, which had promised me of higher returns. I was hoping to build a house in a span of 5 years.”

Narrating the tragic incident that she went through, Meenaben said, “The government should take stern action against all the fraudsters and get our money back.”

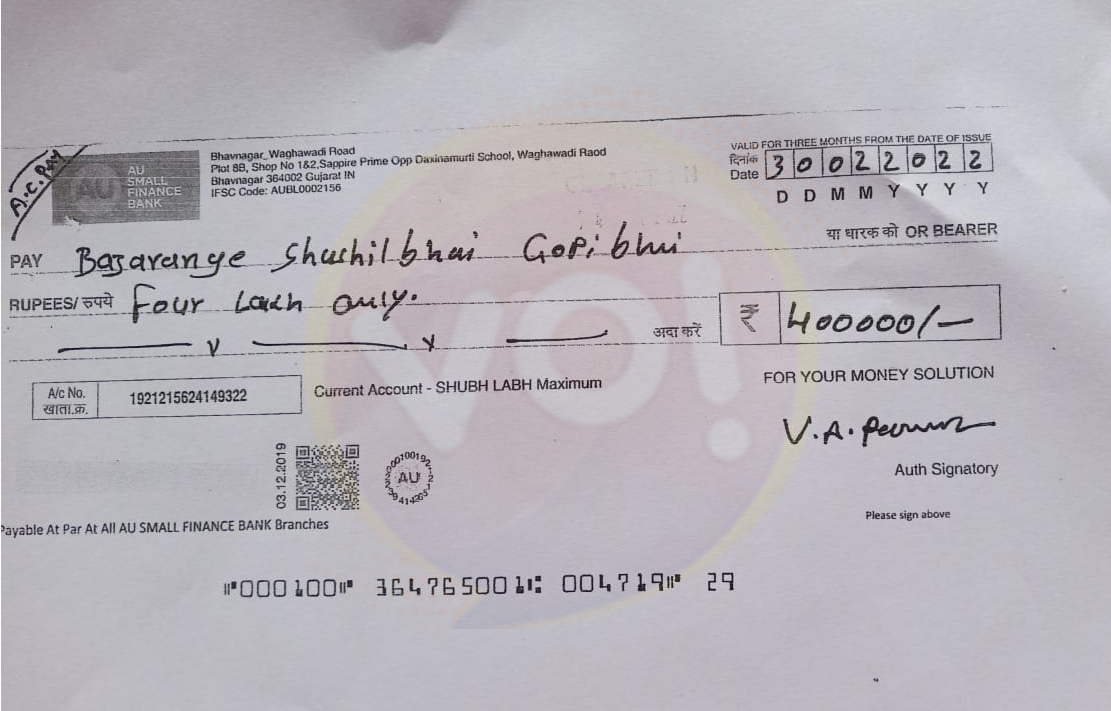

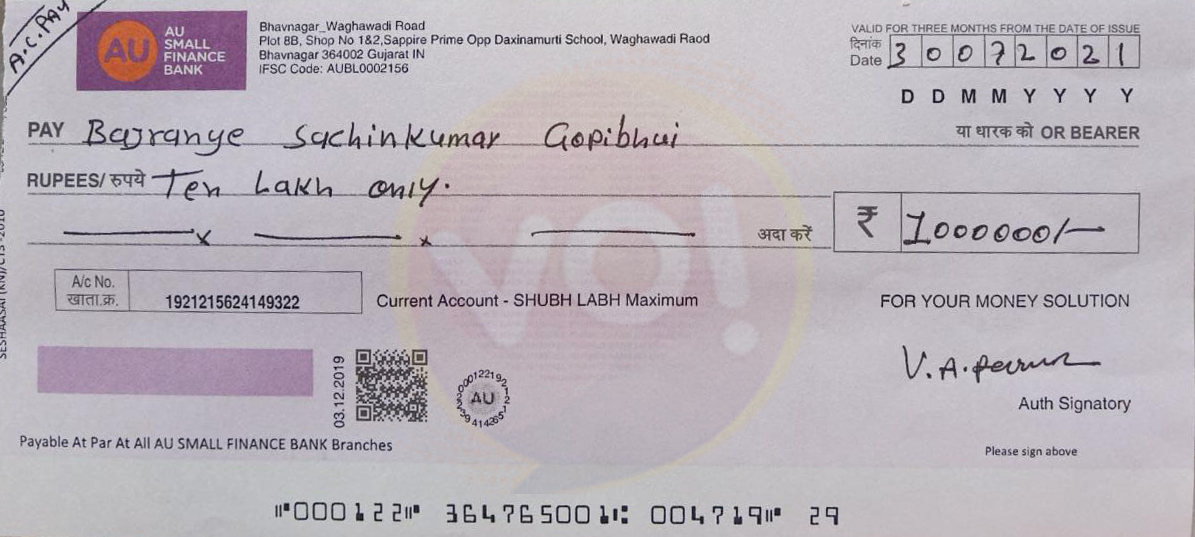

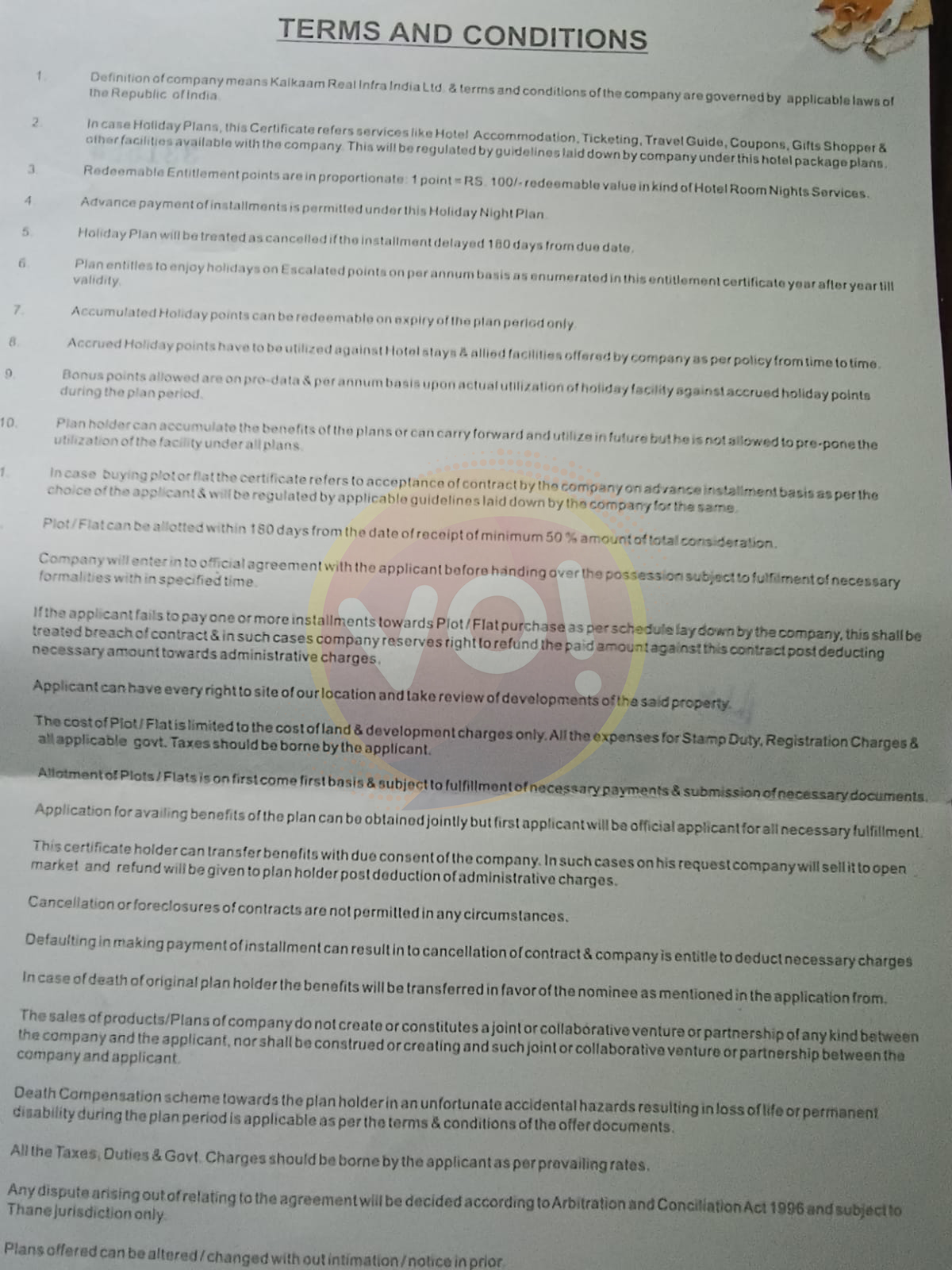

One more heart-breaking story came out from Sanjay Narainbhai Nayak, a resident of Valsad, who said, “I had made a deposit under a savings scheme offered by a Mumbai-based company named- ‘Kalkaam Real Infra (India) Limited. I had made a total investment of around INR 1.9 lakh. After making lucrative promises, the company stopped giving me any returns and cheated on me and others too. I was hoping to fix this amount in building the future of my children, but all of my dreams have ended now. We all have been cheated.”

Earlier in 2016-17, it had appeared that an estimated 1 lakh people from the state invested a total of INR 150 crore in Oscar chit-fund scheme, some in instalments as small as INR 10 a day.

However, over 4.5 lakh people in Gujarat have been waiting for answers over how a multi-crore chit-fund from Odisha managed to take over INR 10,000 crore from investors across the state.

The presence of chit funds, with their convenient schemes, was, and remains, a testimony to just how far India has to go before people start trusting and investing their money via the route of a proper and more trustworthy banking system in India, let alone ‘cashless’ schemes.

This chit fund, like any other private scheme, worked on making people invest through their relatives, and friends and gave the incentive of ‘adding’ people into the system, a source said.

While the mainstream banks seemed complex to the locals, these chit funds kept things extremely simple by working on a daily-deposit scheme, as stated by the source.

For every customer they added to the chit fund, the agents received a one-time commission of 23 per cent of the initial deposit in case of fixed deposit. In the case of daily deposit schemes, they would get 3 per cent of the total monthly deposit they made in the Fund, the following month.

BJP Criticises Rahul Gandhi’s Burberry Tshirt, Congress Reminds Them Of PM’s Rs 10 lakh suit.