Indian share market on Tuesday closed at the highest ever level in history on the back of sustained buying by domestic institutions thwarting any dangers of intense selling by foreign funds. The market has gained 14 per cent from the recent lows recorded on April 22, at the peak of the devastating second wave of Covid19.

In the process, the investors’ wealth (as measured by market capitalisation) has swelled by a whopping Rs37.43 lakh crore between April 22 and August 3. At the close of the trade, total market capitalisation also stood at the highest ever level of Rs.240.04 lakh crore.

Stock Market on Tuesday, a historic Day

The stock market opened on a positive note against the backdrop of weak Asian markets. It continued to gain momentum on buying support and closed at the all-time levels. The Sensex gained 872.73 points to close at 53,823.36. The Nifty gained 245.60 points to close at 16,130.75. This is the highest ever closing for both the benchmark indices.

The biggest contribution in the benchmark indices came from HDFC, Infosys, TCS, ICICI Bank, Hindustan Unilever and Reliance Industries. However, Tata Steel, Bajaj Auto and NTPC declined on profit booking.

Banking, financial services, auto, FMCG, pharma and information technology were the gaining sectors. However, profit-booking pulled down metals and the media sector.

Market Since April lows

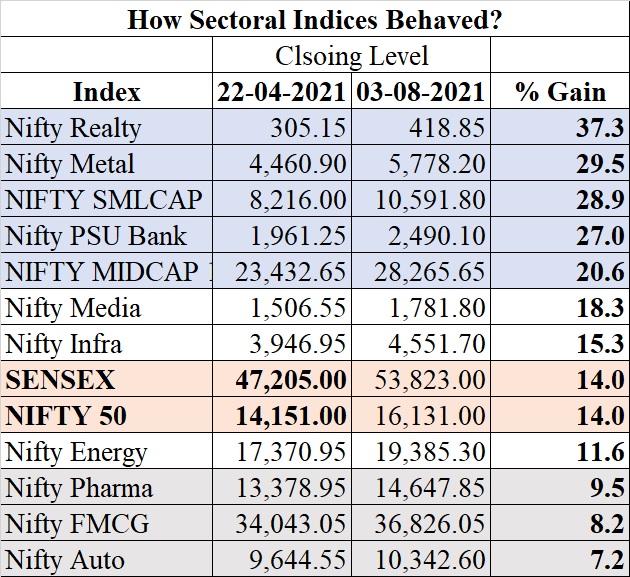

The Sensex hit the recent low of 47,205 and the Nifty was at 14,151 on April 22. The last 72 days has been a dream run for the market. Better earnings for listed corporates in the March and June quarters, positive recovery (in terms of vehicle sales, government’s tax collection) and continuous buying by the domestic funds are the major reasons for the recovery witnessed in the market.

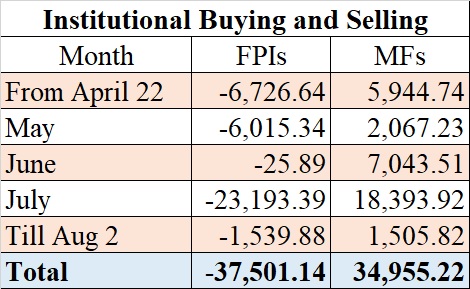

Domestic Funds Drive the Rally

Since April 22, domestic funds have bought shares worth Rs34,955.22 crore against the intense selling by foreign funds. Foreign Portfolio Investors (FPI) have sold shares worth Rs37,504.14 crore during the same period. Mutual Funds are getting new funds every month for investment in equity-related schemes. These funds are putting money in the stock market giving a major relief against the selling by FPIs.

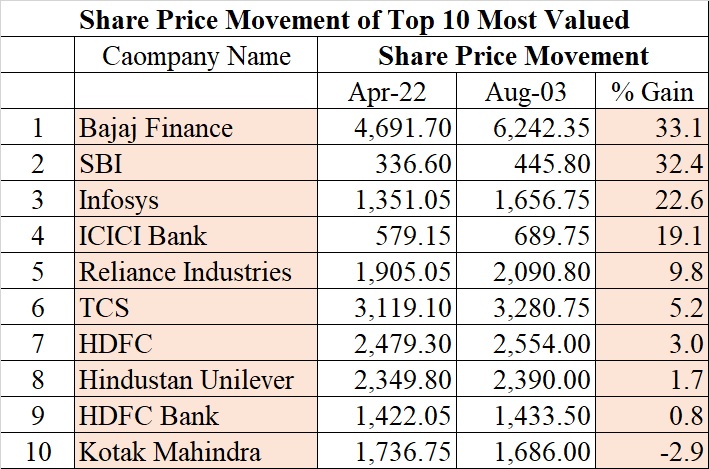

Reliance, ICICI Bank, Infosys, SBI contributes

The biggest contributor for the recovery in the Sensex was largely driven by index heavyweight Reliance Industries, ICICI Bank, Infosys, SBI and Bajaj Finance among the most valued top 10 companies traded in the country. Companies that have disappointed in their earnings HDFC Bank, HDFC, Hindustan Unilever gained the least among the list of elites. Profit booking was seen in Kotak Mahindra Bank which has recorded a decline from the closing share price of April 22.

Real Estate, Metals, Small and Mid-sized companies shine

The outperformance in the market from the April lows was largely driven by the sectors such as real estate, metals, public sector banks. Compared to 14% gain in benchmark indices these sectors gained almost double since April. Even the smallcap and midcap companies gained more than the benchmark indices indicating all round optimism and buying in the market.

The biggest sectors that are showing signs of recovery in consumer demand – auto, pharma and FMCG – underperformed the overall market due to high valuations.